↧

WONDERFUL BEAUTY OF NAGARJUNA FERTILIZERS & CHEMICALS LTD.

↧

Environmental effects Terminology of the environmental effects of elements and compounds

Environmental effects

Terminology of the environmental effects of elements and compounds

LC50 Lethal Concentration 50. An LC50 value is the concentration of a material in air that will kill 50% of the test subjects (animals, typically mice or rats) when administered as a single exposure (typically 1 or 4 hours). This value gives you an idea of the relative toxicity of the material. This value applies to vapors,dusts, mists and gases. Solids and liquids use the closely related LD50 value (50% lethal dose). Lethal Dose 50. It’s the amount of a solid or liquid material that it takes to kill 50% of test animals (for example, mice or rats) in one dose. Toxic is defined by OSHA (Ocupational Safety and Health Administration) 29 CFR 1910.1200 App A as a chemical which falls in any of these three categories:

Highly toxic is defined by OSHA (Ocupational Safety and Health Administration) as:

Toxicology is the study of the nature, effects, detection, and mitigation of poisons and the treatment or prevention of poisoning. A toxin is a toxic substance. Toxins that affect only specific types of cells or organs are called cytotoxins. |

↧

↧

Permissible Exposure Limit (PEL) Time-Weighted Average (TWA)

Permissible Exposure Limit (PEL)

Time-Weighted Average (TWA)

Definition

A Permissible Exposure Limit (PEL) is the maximum amount or concentration of a chemical that a worker may be exposed to under OSHA regulations.

A Time-Weighted Average (TWA) is explained below.

A VPEL or Vacated PEL is an older PEL set by OSHA but later "vacated" (retracted) under court order. However, some states may continue to enforce these lower levels. See below.

Additional Info

PEL's can be defined in two different ways as discussed in the OSHA regulation on air contaminants, 29 CFR 1910.1000:

Ceiling values - at no time should this exposure limit be exceeded. Sometimes denoted with the letter C.

8-hour Time Weighted Averages (TWA) - are an average value of exposure over the course of an 8 hour work shift.

TWA levels are usually lower than ceiling values. Thus, a worker may be exposed to a level higher than the TWA for part of the day (but still lower than the ceiling value) as long as he is exposed to levels below the TWA for the rest of the day.

safety poster

Employees have a Right To Know about the hazards of their workplace. Get your RTK materials at Safety Emporium.

Vacated PEL's

Analyzing the specific health risks and performing the cost/benefit analyses needed to set a PEL is a time-consuming and labor-intensive endeavor. As a result, only ~470 substances have OSHA PEL's.

In 1989, OSHA decided that it was impractical to set PEL's for tens of thousands individual chemicals and enacted a generic rulemaking scheme that broke chemicals up into various categories. This methodology was challenged in court and in AFL-CIO v. OSHA, 965 F.2d 962 the 11th U.S. District Court of Appeals vacated (struck down) the 1989 PEL revisions stating "(1) OSHA failed to establish that existing exposure limits in the workplace presented significant risk of material health impairment or that new standards eliminated or substantially lessened the risk; (2) OSHA did not meet its burden of establishing that its 428 new permissible exposure limits (PELs) were either economically or technologically feasible."

Toxicological professionals generally disagree with both of those points. With respect to the first, there was substantial documentation to support OSHA's position, and with the respect to the second, performing an economic analysis for every chemical (there are well over 100,000 commodity chemicals in use in the US) for every industry is completely infeasible. In 58:35338-35351 OSHA noted that "...OSHA continues to believe that many of the old limits which it will now be enforcing are out of date (they predate 1968) and not sufficiently protective of employee health based on current scientific information and expert recommendations. In addition, many of the substances for which OSHA has no PELs present serious health hazards to employees."

RTK Center

Ensure that your MSDS collection is "readily accessible" with these handy compliance centers from Safety Emporium.

Regardless, OSHA was forced to revert to the older limits. This case clearly established that to set new PEL's OSHA would need to collect specific evidence for each substance so the risk/benefit analysis could be reviewed, and the resources required for that have never been made available and likely never will be available. More information on this legal case can be found under Further Reading below.

In theory, OSHA is continuing to perform risk assessment and feasibility analysis on air contaminants in light of this court ruling, using a risk-based prioritization to identify those substances which have the most significant impact on worker safety. But in the years since this ruling, OSHA has enacted or updated PEL's for just a handful of substances.

Just to confuse matters, this decision did not directly apply to the states and territories which administer their own OSHA-approved plans. Some of these states may retain the 1989 limits. Therefore, to maximize safety and minimize potential legal problems, it is best to compare the 1989 PELs for these substances with the ACGIH limits (TLV's), and comply with which ever is most protective.

Therefore, vacated PEL values may still appear on MSDS's because some states may have enacted statutes based on their values and because some employers or employees might prefer their larger margin of safety (or error, depending on your perspective) when setting their workplace exposure limits. Whatever values you find, always err on the side of safety and choose the lower one. Remember we always want to keep chemical exposures as low as reasonably achievable (ALARA).

Time-Weighted Average (TWA)

Definition

A Permissible Exposure Limit (PEL) is the maximum amount or concentration of a chemical that a worker may be exposed to under OSHA regulations.

A Time-Weighted Average (TWA) is explained below.

A VPEL or Vacated PEL is an older PEL set by OSHA but later "vacated" (retracted) under court order. However, some states may continue to enforce these lower levels. See below.

Additional Info

PEL's can be defined in two different ways as discussed in the OSHA regulation on air contaminants, 29 CFR 1910.1000:

Ceiling values - at no time should this exposure limit be exceeded. Sometimes denoted with the letter C.

8-hour Time Weighted Averages (TWA) - are an average value of exposure over the course of an 8 hour work shift.

TWA levels are usually lower than ceiling values. Thus, a worker may be exposed to a level higher than the TWA for part of the day (but still lower than the ceiling value) as long as he is exposed to levels below the TWA for the rest of the day.

safety poster

Employees have a Right To Know about the hazards of their workplace. Get your RTK materials at Safety Emporium.

Vacated PEL's

Analyzing the specific health risks and performing the cost/benefit analyses needed to set a PEL is a time-consuming and labor-intensive endeavor. As a result, only ~470 substances have OSHA PEL's.

In 1989, OSHA decided that it was impractical to set PEL's for tens of thousands individual chemicals and enacted a generic rulemaking scheme that broke chemicals up into various categories. This methodology was challenged in court and in AFL-CIO v. OSHA, 965 F.2d 962 the 11th U.S. District Court of Appeals vacated (struck down) the 1989 PEL revisions stating "(1) OSHA failed to establish that existing exposure limits in the workplace presented significant risk of material health impairment or that new standards eliminated or substantially lessened the risk; (2) OSHA did not meet its burden of establishing that its 428 new permissible exposure limits (PELs) were either economically or technologically feasible."

Toxicological professionals generally disagree with both of those points. With respect to the first, there was substantial documentation to support OSHA's position, and with the respect to the second, performing an economic analysis for every chemical (there are well over 100,000 commodity chemicals in use in the US) for every industry is completely infeasible. In 58:35338-35351 OSHA noted that "...OSHA continues to believe that many of the old limits which it will now be enforcing are out of date (they predate 1968) and not sufficiently protective of employee health based on current scientific information and expert recommendations. In addition, many of the substances for which OSHA has no PELs present serious health hazards to employees."

RTK Center

Ensure that your MSDS collection is "readily accessible" with these handy compliance centers from Safety Emporium.

Regardless, OSHA was forced to revert to the older limits. This case clearly established that to set new PEL's OSHA would need to collect specific evidence for each substance so the risk/benefit analysis could be reviewed, and the resources required for that have never been made available and likely never will be available. More information on this legal case can be found under Further Reading below.

In theory, OSHA is continuing to perform risk assessment and feasibility analysis on air contaminants in light of this court ruling, using a risk-based prioritization to identify those substances which have the most significant impact on worker safety. But in the years since this ruling, OSHA has enacted or updated PEL's for just a handful of substances.

Just to confuse matters, this decision did not directly apply to the states and territories which administer their own OSHA-approved plans. Some of these states may retain the 1989 limits. Therefore, to maximize safety and minimize potential legal problems, it is best to compare the 1989 PELs for these substances with the ACGIH limits (TLV's), and comply with which ever is most protective.

Therefore, vacated PEL values may still appear on MSDS's because some states may have enacted statutes based on their values and because some employers or employees might prefer their larger margin of safety (or error, depending on your perspective) when setting their workplace exposure limits. Whatever values you find, always err on the side of safety and choose the lower one. Remember we always want to keep chemical exposures as low as reasonably achievable (ALARA).

↧

Functions of the Central Pollution Control Board at the National Level

|  | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

↧

Raghuram Rajan meets PM, finance minister; FIIs buy shares worth $1 billion

Raghuram Rajan meets PM, finance minister; FIIs buy shares worth $1 billion

NEW DELHI: Ahead of his maiden monetary policy review, Reserve Bank governor Raghuram Rajan on Tuesday met Prime Minister Manmohan Singh and finance minister P Chidambaram and discussed the macroeconomic situation.

"RBI has constant consultation with finance ministry. This meeting was part of that. We discussed the whole gambit of issues," he told reporters after meeting Chidambaram.

Sources said during his meeting with the Prime Minister, the governor discussed the state of the economy and steps required to address the current slowdown and high inflation.

Rajan, who was chief economic advisor in the finance ministry before taking over as RBI governor on September 4, is scheduled to announce the mid-quarter monetary policy review on September 20.

All eyes are on the policy announcement considering the inflation climbing to six months high of 6.1 per cent in August, concerns on depreciating rupee and slowing growth.

High inflation offers Rajan limited scope to cut key rates as demanded by industry.

Soon after being named for the new assignment, Rajan had said there was no "magic wand" to pull the economy instantly out of challenges it faces.

"We have recommended a cut in CRR, repo rate and asked RBI not to restrict the MSF (marginal standing facility) to a particular number ..." State Bank of India (SBI) chairman Pratip Chaudhuri said.

As the peak festival season is around the corner, bankers are pressing for a cut in cash reserve ratio and policy rates by the Reserve Bank to boost demand for manufactured goods and revive sagging economic growth.

Demand for loans are expected to go up in the ensuing festive season and banks would be able to disburse loans at the lower rate if RBI cuts rate, Indian Overseas Bank Chairman and Managing Director M Narendra said.

In its last policy review on July 29, RBI chose to keep all key interest rates unchanged on account of weak rupee.

Markets have given a thumbs up to Rajan's road map to revive the economy, with the rupee coming off its record low.

FIIs buy shares worth $1 billion

Foreign institutional investors (FIIs) have bought shares worth $1 billion in the past eight trading sessions following RBI governor Raghuram Rajan's recent announcements, a Deutsche Bank report said.

According to the global financial services major, FIIs have recouped around 25 per cent of the outflows seen over the June-August period, when the country witnessed its sharpest bout of FII outflows since the global financial crisis.

Between June and August 2013, India saw FII outflows of $4 billion, leading to fears of a possible capitulation by FII's, the Deutsche Bank report said.

"Following incoming governor Raghuram Rajan's announcements on assuaging currency markets and particularly after the news flow over the FCNR-B swap announcements, we have seen the rupee partially recovering its losses and FII's emerging as net buyers of close to USD 1 billion over the past 8 trading sessions," Deutsche Bank said.

As per the report, investor sentiments were boosted following the recent announcements over the FCNR-B, supportive trade data and easing investment facilitation in debt markets.

These measures have resulted in imparting "long needed and much sought after credibility over both - the financing of the CAD and the actual CAD," Deutsche Bank said adding a tempering of the Syria risk have also assuaged investors, aiding inflows.

Moreover, investors are keenly expecting a fuel price hike (both one time as well as a higher monthly calibrated hike). "Convergence of political will on critical economic issues also bodes well," it said.

The rupee is currently, hovering around the 62/dollar level. The local currency had depreciated to an all-time low of 68.85 on August 28.

Citing anecdotal evidence, HSBC said bouts of sharp currency depreciation in India have generally been followed by periods of strong FII inflows into equities.

Earlier, between September and December 2011, a rupee depreciation of 13 per cent was followed by a period of FII inflows of USD 8 billion over the next three months.

Similarly, rupee depreciation of 11 per cent over March-June 2012 was followed by FII inflows of USD 6 billion over next three months.

"Investors are now watching both the Fed policy on September 18th and more importantly the RBI credit policy on September 20th," the report said.

"RBI has constant consultation with finance ministry. This meeting was part of that. We discussed the whole gambit of issues," he told reporters after meeting Chidambaram.

Sources said during his meeting with the Prime Minister, the governor discussed the state of the economy and steps required to address the current slowdown and high inflation.

Rajan, who was chief economic advisor in the finance ministry before taking over as RBI governor on September 4, is scheduled to announce the mid-quarter monetary policy review on September 20.

All eyes are on the policy announcement considering the inflation climbing to six months high of 6.1 per cent in August, concerns on depreciating rupee and slowing growth.

High inflation offers Rajan limited scope to cut key rates as demanded by industry.

Soon after being named for the new assignment, Rajan had said there was no "magic wand" to pull the economy instantly out of challenges it faces.

"We have recommended a cut in CRR, repo rate and asked RBI not to restrict the MSF (marginal standing facility) to a particular number ..." State Bank of India (SBI) chairman Pratip Chaudhuri said.

As the peak festival season is around the corner, bankers are pressing for a cut in cash reserve ratio and policy rates by the Reserve Bank to boost demand for manufactured goods and revive sagging economic growth.

Demand for loans are expected to go up in the ensuing festive season and banks would be able to disburse loans at the lower rate if RBI cuts rate, Indian Overseas Bank Chairman and Managing Director M Narendra said.

In its last policy review on July 29, RBI chose to keep all key interest rates unchanged on account of weak rupee.

Markets have given a thumbs up to Rajan's road map to revive the economy, with the rupee coming off its record low.

FIIs buy shares worth $1 billion

Foreign institutional investors (FIIs) have bought shares worth $1 billion in the past eight trading sessions following RBI governor Raghuram Rajan's recent announcements, a Deutsche Bank report said.

According to the global financial services major, FIIs have recouped around 25 per cent of the outflows seen over the June-August period, when the country witnessed its sharpest bout of FII outflows since the global financial crisis.

Between June and August 2013, India saw FII outflows of $4 billion, leading to fears of a possible capitulation by FII's, the Deutsche Bank report said.

"Following incoming governor Raghuram Rajan's announcements on assuaging currency markets and particularly after the news flow over the FCNR-B swap announcements, we have seen the rupee partially recovering its losses and FII's emerging as net buyers of close to USD 1 billion over the past 8 trading sessions," Deutsche Bank said.

As per the report, investor sentiments were boosted following the recent announcements over the FCNR-B, supportive trade data and easing investment facilitation in debt markets.

These measures have resulted in imparting "long needed and much sought after credibility over both - the financing of the CAD and the actual CAD," Deutsche Bank said adding a tempering of the Syria risk have also assuaged investors, aiding inflows.

Moreover, investors are keenly expecting a fuel price hike (both one time as well as a higher monthly calibrated hike). "Convergence of political will on critical economic issues also bodes well," it said.

The rupee is currently, hovering around the 62/dollar level. The local currency had depreciated to an all-time low of 68.85 on August 28.

Citing anecdotal evidence, HSBC said bouts of sharp currency depreciation in India have generally been followed by periods of strong FII inflows into equities.

Earlier, between September and December 2011, a rupee depreciation of 13 per cent was followed by a period of FII inflows of USD 8 billion over the next three months.

Similarly, rupee depreciation of 11 per cent over March-June 2012 was followed by FII inflows of USD 6 billion over next three months.

"Investors are now watching both the Fed policy on September 18th and more importantly the RBI credit policy on September 20th," the report said.

Monetary policy: Raghuram Rajan seen hawkish on debut, may roll back some FX steps

New Reserve Bank of India chief Raghuram Rajan makes his first monetary policy statement on Friday with expectations he may scale back some of the emergency measures that have helped the rupee bounce from a record low.

But in a reflection of the policy challenges faced by the former IMF chief economist who has been dubbed "The Guv" by the Indian media, Rajan is likely to strike a hawkish ton...See More

New Reserve Bank of India chief Raghuram Rajan makes his first monetary policy statement on Friday with expectations he may scale back some of the emergency measures that have helped the rupee bounce from a record low.

But in a reflection of the policy challenges faced by the former IMF chief economist who has been dubbed "The Guv" by the Indian media, Rajan is likely to strike a hawkish ton...See More

- 143 people like this.

![]()

- DrAmar NathgiriLast Updated: Thursday September 19, 2013 6:04:56 PM

thank god

USD INR

$ 1 USD Rs 61.91 INR

$ 5 USD Rs 309.56 INR...See More - Raghuram Rajannow 62.61

- DrAmar Nathgirihttp://themoneyconverter.com/USD/INR.aspx SIR HERE IT IS SHOWING $ 1 USD Rs 61.86 INR

![]() themoneyconverter.comConvert USD to INR Currency: United States Dollar (USD), Country: United States ...See More

themoneyconverter.comConvert USD to INR Currency: United States Dollar (USD), Country: United States ...See More - DrAmar NathgiriI LIKE YOUR WAY OF THINKING SIR

![]()

- DrAmar Nathgirihttp://www.nytimes.com/...

![]() www.nytimes.comA central bank official in Indonesia, whose currency has plummeted in recent mon...See More

www.nytimes.comA central bank official in Indonesia, whose currency has plummeted in recent mon...See More

↧

↧

Four Million Safe Man-Hours for the man hours worked by Associates Congratulation by V.P. SHRI R. RAGHAVAN

UNDER THE RCMS WE HAVE CIRCULATED TO THE PUBLIC

Raghavan R --- Four Million Safe Man-Hours for the man hours worked by Associates ---

Dear All,

I am very happy to inform that, we have completed Four Million safe man-hours as on 18.09.2013 for the man-hours worked by associates, which is equivalent to 855 accident-free days.

I congratulate all the associates for this remarkable achievement.

I wish that all of us should continue our efforts and strive to embark many more such landmarks in future.

Best Regards,

R. Raghavan

Vice President (Operations & Projects)

![]()

![]()

![]()

![]()

Raghavan R --- Four Million Safe Man-Hours for the man hours worked by Associates ---

Dear All,

I am very happy to inform that, we have completed Four Million safe man-hours as on 18.09.2013 for the man-hours worked by associates, which is equivalent to 855 accident-free days.

I congratulate all the associates for this remarkable achievement.

I wish that all of us should continue our efforts and strive to embark many more such landmarks in future.

Best Regards,

R. Raghavan

Vice President (Operations & Projects)

INDUSTRIAL HYGIENE QUIZ

1. Industrial hygiene concerns itself only with the control of occupational diseases. So its contribution to accident prevention is nil.

(False)

2. Safety engineer should only be interested in the physical damage, broken bones and bloody injuries.

(False)

3. Safety engineer cannot be away from the control of occupational diseases.

(True)

4. It is the responsibility of the industrial hygienist to study an environment for the pollutants and defects and safety engineers come to the picture while implementing the recommendations of the industrial hygienist is taken up

(True)

5. The key concepts of industrial hygiene program are:

(Recognition, evaluation, controle, recommendation)

6. Evaluation and control of the environment can be purposeful and effective only if the recognition of the pollutant is perfect.

(True)

7. Evaluation of an environmental pollution does end with the measurement of concentration of that pollution.

(False)

8. A measure of the damage of the environmental pollution on the human being also forms of the evaluation.

(False)

9. Controlling an environment calls for much experience.

(True)

10. For controlling an environmental pollution that emanates from a process, it is not required to know the nature of the process that is going on.

(True)

11. Controle measures taken against taken against environmental pollution differ widely with operations.

(True)

12. Some of the chemicals sensitize the skin. Most of the epoxy resins have this quality of the following, Which are sensitizing agents?

(Araldite, Quick fix, synthetic rubber, tar)

13. Oil dermatitis can be caused by the contact with.

(Mineral oils)

14. Skin disease incidence depends on ..

(Age, Sex, Dietary habits, Heredity)

15. Women are more prone to skin disease than men because..

(Their skin is very tender)

16. Personal hygiene is more important to fight against Dermatitis.

(True)

17. Continuous contact with cloths soiled with an irritant also can cause dermatitis

(True)

18. While selecting a glove to guard against dermatitis, the following must be considered

(Whether the glove will dissolve in the oil against which it is used;

Whether it will allow any oil through it;

Whether it will interferes with material handling )

19. Barrier cream application interferes with material handling.

(False)

20. Barrier cream interfere with sweating.

(False)

21. Barrier cream is effective only for 2½ hrs. So, only repeated application is purposeful.

(True)

22. Barrier cream is effective only if the contact with irritant is going to be just occasional.

(True)

23. Barrier cream can also be used against corrosive materials.

(False)

24. Barrier cream is a failure against certain chemicals.

(True)

25. Aerosols are those that can keep floating in the air, Can you make them in the following?

(Gas, Mist, fume, Smoke, Vapor, Dust)

26. Aerosols get in to system only through inhalation.

(True)

27. Some of the aerosols enter the system through skin too.

(True)

28. Dusts are produced by size reduction of solids.

(True)

29. Dusts follow the gravitational law and they do settle down.

(True)

30. Their rate of settling depends on.

(Particle size, density)

31. Particle size of a dust is mentioned as the diameter of the sphere in which the dust could be accommodated.

(True)

32. Nasal hair filter particles whose size goes beyond 10 microns. So, particles of respirable range have a size less than 10 microns.

(True)

33. All dusts entering the system settle in lungs.

(False)

34. All dusts reach alveoli, the minute sac of the lung, and settle there.

(False)

35. When a dust reaches a spot in the lung, fibrous hardening takes place in that spot and this is the defensive mechanism of the system.

(True)

36. Those hardening leads to a less oxygen transferring capacity of the lung and this further leads to shortness of breath.

(True)

37. The condition of dusty lung is medically called as pneumoconiosis (Pneumo-lung, coni-dust, osis-condition). Can you match the following?

Dust Condition of lung

Silica Silicosis

Asbestos Asbestosis

Coal Anthracosis

Alumina Aluminosis

Iron Siderosis

38. The damage of a dust is determined by its efficiency to lead to secondary infection.

(True)

39. Silica is the most dangerous dust, as the silicotic lung is a good seat for tuberculosis.

(True)

40. Gases are defined as formless Fluids which can be compressed to liquids or solids with decrease in temperature and increase in pressure. Can you tick in the following all those that are gases?

(Ammonia, ozone, carbon monoxide, Nitrogen di-oxide, Sulphur di-oxide, Nitrogen, Oxygen Methane)

41. Some of the gases when inhaled irritate the mucous membrane of the respiratory system. They are called gaseous irritants. In the following list, tick them:

(Ozone, Hydrogen chloride, chlorine, oxides of nitrogen, ammonia, sulphur di-oxide)

42. There is no natural defense mechanism against these irritants

(True)

43. Oxides of nitrogen is produced more in the case of gas shielded arc than in manual arc welding.

(False)

44. Ozone is produced during arc welding because of the ultra violet radiation. So ozone is produced wherever the radiation reaches.

(True)

45. Respiratory tract constricts while inhaling and this constriction is called as spasm. Spasm may not lead to death.

(True)

46. Respirators are the best solution to avoid inhaling irritants.

(False)

47. Some gases when inhaled interfere with the oxygen transfer at the lung and thus deprive the system of oxygen. They are called asphyxiants. Here follows a list:

(Carbon monoxide, Carbon Di oxide, Acetylene, Argon, Nitrogen, Helium)

48. Carbon monoxide combines chemically with hemoglobin to form carboxyl Hemoglobin. So it is called chemical asphyxiate.

(True)

49. Gases that transfer with the oxygen transfer, just because of their presence and influence on oxygen partial pressure are called simple asphyxiates. Other than carbon monoxide and Hydrogen Cyanide, the rest come in this list.

(True)

50. Exposure to Asphixants only at higher concentrations is fatel.

(True)

51. Simple asphyxiants is more harmful than the chemical asphyxiant because it affects the partial pressure of oxygen.

(False)

52. Physical asphyxiants require higher concentrations to bring in the damage, while chemical asphyxiants do the same even at lower concentrations.

(True)

53. Recovery to normal health is immediate if the man is removed from the environment polluted with an asphyxiant.

(True)

(False)

2. Safety engineer should only be interested in the physical damage, broken bones and bloody injuries.

(False)

3. Safety engineer cannot be away from the control of occupational diseases.

(True)

4. It is the responsibility of the industrial hygienist to study an environment for the pollutants and defects and safety engineers come to the picture while implementing the recommendations of the industrial hygienist is taken up

(True)

5. The key concepts of industrial hygiene program are:

(Recognition, evaluation, controle, recommendation)

6. Evaluation and control of the environment can be purposeful and effective only if the recognition of the pollutant is perfect.

(True)

7. Evaluation of an environmental pollution does end with the measurement of concentration of that pollution.

(False)

8. A measure of the damage of the environmental pollution on the human being also forms of the evaluation.

(False)

9. Controlling an environment calls for much experience.

(True)

10. For controlling an environmental pollution that emanates from a process, it is not required to know the nature of the process that is going on.

(True)

11. Controle measures taken against taken against environmental pollution differ widely with operations.

(True)

12. Some of the chemicals sensitize the skin. Most of the epoxy resins have this quality of the following, Which are sensitizing agents?

(Araldite, Quick fix, synthetic rubber, tar)

13. Oil dermatitis can be caused by the contact with.

(Mineral oils)

14. Skin disease incidence depends on ..

(Age, Sex, Dietary habits, Heredity)

15. Women are more prone to skin disease than men because..

(Their skin is very tender)

16. Personal hygiene is more important to fight against Dermatitis.

(True)

17. Continuous contact with cloths soiled with an irritant also can cause dermatitis

(True)

18. While selecting a glove to guard against dermatitis, the following must be considered

(Whether the glove will dissolve in the oil against which it is used;

Whether it will allow any oil through it;

Whether it will interferes with material handling )

19. Barrier cream application interferes with material handling.

(False)

20. Barrier cream interfere with sweating.

(False)

21. Barrier cream is effective only for 2½ hrs. So, only repeated application is purposeful.

(True)

22. Barrier cream is effective only if the contact with irritant is going to be just occasional.

(True)

23. Barrier cream can also be used against corrosive materials.

(False)

24. Barrier cream is a failure against certain chemicals.

(True)

25. Aerosols are those that can keep floating in the air, Can you make them in the following?

(Gas, Mist, fume, Smoke, Vapor, Dust)

26. Aerosols get in to system only through inhalation.

(True)

27. Some of the aerosols enter the system through skin too.

(True)

28. Dusts are produced by size reduction of solids.

(True)

29. Dusts follow the gravitational law and they do settle down.

(True)

30. Their rate of settling depends on.

(Particle size, density)

31. Particle size of a dust is mentioned as the diameter of the sphere in which the dust could be accommodated.

(True)

32. Nasal hair filter particles whose size goes beyond 10 microns. So, particles of respirable range have a size less than 10 microns.

(True)

33. All dusts entering the system settle in lungs.

(False)

34. All dusts reach alveoli, the minute sac of the lung, and settle there.

(False)

35. When a dust reaches a spot in the lung, fibrous hardening takes place in that spot and this is the defensive mechanism of the system.

(True)

36. Those hardening leads to a less oxygen transferring capacity of the lung and this further leads to shortness of breath.

(True)

37. The condition of dusty lung is medically called as pneumoconiosis (Pneumo-lung, coni-dust, osis-condition). Can you match the following?

Dust Condition of lung

Silica Silicosis

Asbestos Asbestosis

Coal Anthracosis

Alumina Aluminosis

Iron Siderosis

38. The damage of a dust is determined by its efficiency to lead to secondary infection.

(True)

39. Silica is the most dangerous dust, as the silicotic lung is a good seat for tuberculosis.

(True)

40. Gases are defined as formless Fluids which can be compressed to liquids or solids with decrease in temperature and increase in pressure. Can you tick in the following all those that are gases?

(Ammonia, ozone, carbon monoxide, Nitrogen di-oxide, Sulphur di-oxide, Nitrogen, Oxygen Methane)

41. Some of the gases when inhaled irritate the mucous membrane of the respiratory system. They are called gaseous irritants. In the following list, tick them:

(Ozone, Hydrogen chloride, chlorine, oxides of nitrogen, ammonia, sulphur di-oxide)

42. There is no natural defense mechanism against these irritants

(True)

43. Oxides of nitrogen is produced more in the case of gas shielded arc than in manual arc welding.

(False)

44. Ozone is produced during arc welding because of the ultra violet radiation. So ozone is produced wherever the radiation reaches.

(True)

45. Respiratory tract constricts while inhaling and this constriction is called as spasm. Spasm may not lead to death.

(True)

46. Respirators are the best solution to avoid inhaling irritants.

(False)

47. Some gases when inhaled interfere with the oxygen transfer at the lung and thus deprive the system of oxygen. They are called asphyxiants. Here follows a list:

(Carbon monoxide, Carbon Di oxide, Acetylene, Argon, Nitrogen, Helium)

48. Carbon monoxide combines chemically with hemoglobin to form carboxyl Hemoglobin. So it is called chemical asphyxiate.

(True)

49. Gases that transfer with the oxygen transfer, just because of their presence and influence on oxygen partial pressure are called simple asphyxiates. Other than carbon monoxide and Hydrogen Cyanide, the rest come in this list.

(True)

50. Exposure to Asphixants only at higher concentrations is fatel.

(True)

51. Simple asphyxiants is more harmful than the chemical asphyxiant because it affects the partial pressure of oxygen.

(False)

52. Physical asphyxiants require higher concentrations to bring in the damage, while chemical asphyxiants do the same even at lower concentrations.

(True)

53. Recovery to normal health is immediate if the man is removed from the environment polluted with an asphyxiant.

(True)

↧

G-5 Research and Technology Group

G-5 Research and Technology Group

http://www.gfiveinternational.com/G5-research.html

![]()

http://www.gfiveinternational.com/G5-research.html

G-5 Research and Technology Group will be working with current technologies made possible by modern, concentrated energy forms to capture and harness dispersed renewable energy potential into concentrated forms. Renewable energy plays a major role in the economies of the developing world.

Renewable energy relies upon the natural forces at work upon the earth, including the internal heat represented by geothermal, the pull of lunar gravity as it affects the potential for tidal power, and solar radiation such as that stored through photosynthesis in biomass.

Renewable Energy in the US About 9 percent of all energy consumed in the United States in 2011 was from renewable sources, and they account for about 13 percent of the nation’s total electricity production.

While a relatively small fraction of our overall energy supply in 20010, the United States was the world’s largest consumer of renewable energy from geothermal, solar, wood, wind, and waste for electric power generation using some 25% of the world’s total. In 2011, the distribution of U.S. renewable consumption by source was:

- Hydropower 35%

- Biomass Wood 22%

- Biomass Waste 5%

- Biomass Biofuels 21%

- Wind 13%

- Other 4%

According to the Energy Information Administration, “renewable energy refers to resources that are replenished in a relatively short period of time.” Renewable energy sources include hydropower, wood biomass (used to generate heat and electricity), alternative biomass fuels (such as ethanol and biodiesel), waste, geothermal, wind, and solar.

The use of renewable fuels dates to Neolithic times, when cave dwellers made fire from wood and other biomass for cooking and heating. For thousands of years thereafter, renewable energy was all humans used. The small amounts of energy accessible to humans through traditional dispersed renewable energy sources meant that for millennia, human lives remained unchanged.

Today, many are seeking to use technology made possible by modern, concentrated energy forms to capture and harness dispersed renewable energy potential into concentrated forms. Renewable energy plays a major role in the economies of the developing world.

Renewable energy relies upon the natural forces at work upon the earth, including the internal heat represented by geothermal, the pull of lunar gravity as it affects the potential for tidal power, and solar radiation such as that stored through photosynthesis in biomass.

Renewable Energy in the US About 9 percent of all energy consumed in the United States in 2011 was from renewable sources, and they account for about 13 percent of the nation’s total electricity production.

While a relatively small fraction of our overall energy supply in 20010, the United States was the world’s largest consumer of renewable energy from geothermal, solar, wood, wind, and waste for electric power generation using some 25% of the world’s total. In 2011, the distribution of U.S. renewable consumption by source was:

- Hydropower 35%

- Biomass Wood 22%

- Biomass Waste 5%

- Biomass Biofuels 21%

- Wind 13%

- Other 4%

While hydropower is the biggest source of renewable energy in the United States, solar power – particularly photovoltaic cell conversion to electricity – is far and away the smallest, accounting for about four 100th of one percent of the net electricity produced in the United States in 2011.

Globally, the use of hydroelectricity and other grid-connected renewable energy sources is expected to grow slowly over the next couple of decades, increasing at a rate of 2.9 percent per year until 2035, according to the Energy Information Administration (EIA). Most of that growth will come from the construction of new hydropower and wind generating facilities and increased biofuels production. The renewable share of total world energy consumption is expected to rise from 10.2 percent in 2008 to 14.2 percent in 2035. VRG plans to stay on the cutting edge of modern day research implementing new ideas for a promising new future.

↧

Environment ban reimposed on polluted Vapi

Environment ban reimposed on polluted Vapi

The Union ministry of environment and forests (MoEF) on Tuesday re-imposed the ban on any permission to any new or expansion of project that is to come up in Vapi.

AHMEDABAD: Vapi and the industrial estate in its vicinity have once again made it to the list of the most polluted place in the country. The Union ministry of environment and forests (MoEF) on Tuesday re-imposed the ban on any permission to any new or expansion of project that is to come up in Vapi.

"Even after two and half years of implementation of action plan there is no improvement in the environmental quality of Vapi," claims the latest notification of ministry of environment and forests.

This industrial estate in south Gujarat in Valsad district has been rated by the Union ministry as being "critically polluted" after it found the quality of air, water, land and ground water not meeting 'desired' standards.

What is significant is that the MoEF had lifted the ban on the industrial town on October 26, 2011, after the Vapi industrial zone and the Gujarat pollution control board (GPCB) assured the MoEF that it would implement its action plan to improve environment quality of the town, claims the notification.

The ban or moratorium on industrial expansion was imposed by MoEF back in 2010 based on the Comprehensive Environment Pollution Index (CEPI) — a score sheet on pollution developed by IIT-Delhi and central pollution control board (CPCB).

CEPI scores of 70 and above were considered as critically polluted industrial clusters, whereas the areas having CEPI between 60-70 were considered as severely polluted areas and shall be kept under surveillance.

Vapi was found to be 88.09 in year 2010, while the latest CEPI index score this year showed that Vapi still topped the pollution charts with a score of 85.31. This meant that pollutant concentration and impact on human health and level of exposure of humans to the pollution was very high.

Along with Vapi town on the latest pollution list are Singraulli, Ghaziabad, Panipat, Indore, Ludhiana, Jharsuguda, Patancheru-Bollaram.

↧

Sustainable Mountain development summit III Kohima Summit 2013

ustainable Mountain development summit III

Kohima Summit 2013

THE SUSTAINABLE MOUNTAIN DEVELOPMENT SUMMIT A PLATFORM OF THE INDIAN MOUNTAIN INITIATIVE (IMI) FOR INDIAN HIMALAYAN STATES TO COME TOGETHER TO SHARE EXPERIENCES, DISCUSS ISSUES OF DEVELOPMENT PRIORITY, AS WELL AS , TO FIND WAYS TO INFLUENCE NATIONAL AND STATE PUBLIC POLICIES.

Date

The dates for the Summit are 25 – 27 September 2013.venue

The venue will be the NBCC Convention Centre at Kohima and other government establishments backing up as committee rooms or venues for side events, thus considerably cutting down on costs. Participants will be housed in hotels and home stays in Kohima town.

SMDS-III SCHEDULE

To view and download the tentative schedule of the SMDS-III, Kohima summit please see the SCHEDULE PAGE.

Summit themes

- Forests– Governance, challenges and opportunities

- Water– rivers, streams and springs

- AgricultureSustainable Mountain Agriculture - small scale farming

Cross-cutting themes

Each of the themes shall be supplemented by sub themes that will further broaden the subject matter but with a focus. The themes will be interlinked and further enriched through the cross-cutting themes listed below.

- Climate change adaptation

- Ecosystem services

- Biodiversity conservation

- Gender

how do i participate ?

what if i am not from a mountain state ?

how do i submit papers for the summit ?

For other FAQs

Events of the Kohima Summit

The Summit

The main event would bring together the results of the different theme based workshop unto one common platform, and move towards building upon it leading to a consensus on the same. The workshop would also attempt to have a more detailed plenary session, with minimum isolation between the groups working on the different themes.

Questions such of “what has the IMI done or followed up on the deliberations since the last two summits?” or “How are you building upon what your learnings are?” have made us – the organisers of the SMDS-III – ponder about the delivery mechanism or methodologies of the Summit. As part of our planning process, we have worked out a methodology and format of the SMDS-III without compromising on any of the past strengths of the past two summits.

The call for papers from across the region on the selected themes shall continue so that the Summit provides the platform for researchers, practitioners and experts from across the mountain states to share their knowledge, experiences and concerns. This not only provides an opportunity for such papers to be showcased and published but also allows other stakeholders and participants to know about the existence of such studies and experiences. As is the process, the papers shall be remotely reviewed and vetted by subject matter experts in each thematic subject before it is finally accepted for the Summit.

Once the papers are all received, the expert team or a consultant expert shall be assigned to collectively synthesize all the papers received in a single theme into a single lead paper which will later be presented in the respective break-away group. All participants will receive a CD in their Summit Kit which will they will receive upon checking in to the hotels. The CD will contain all the papers from all three themes, information on the IMI, SDFN and other resource materials. The documents will also be available in advance on the Summit page of the SDFN website

Questions such of “what has the IMI done or followed up on the deliberations since the last two summits?” or “How are you building upon what your learnings are?” have made us – the organisers of the SMDS-III – ponder about the delivery mechanism or methodologies of the Summit. As part of our planning process, we have worked out a methodology and format of the SMDS-III without compromising on any of the past strengths of the past two summits.

The call for papers from across the region on the selected themes shall continue so that the Summit provides the platform for researchers, practitioners and experts from across the mountain states to share their knowledge, experiences and concerns. This not only provides an opportunity for such papers to be showcased and published but also allows other stakeholders and participants to know about the existence of such studies and experiences. As is the process, the papers shall be remotely reviewed and vetted by subject matter experts in each thematic subject before it is finally accepted for the Summit.

Once the papers are all received, the expert team or a consultant expert shall be assigned to collectively synthesize all the papers received in a single theme into a single lead paper which will later be presented in the respective break-away group. All participants will receive a CD in their Summit Kit which will they will receive upon checking in to the hotels. The CD will contain all the papers from all three themes, information on the IMI, SDFN and other resource materials. The documents will also be available in advance on the Summit page of the SDFN website

Day One – 25th Sept 2013

Plenary I (Inauguration):

The inauguration shall be more ceremonial, brief and will only have introductory remarks and addresses from chief guest, the SDFN and the IMI and dignitaries present. The inauguration shall immediately be followed by the opening of the photo competition and other exhibit areas, group photograph followed by tea and informal interactions, cultural program and dinner.

Day Two – 26th Sept 2013

Plenary II (General Session - 1):

This plenary will have the key note presentations on each of the three themes. The speakers should ideally be renowned personalities on the subject matters who have been briefed in advance so that the presentations encompass issues that the Summit wishes to address, deliberate and work upon.

This session will also have the presentation/s reflecting the “Voices of Mountain Youths” so that their concerns, ideas and challenges are included and not lost during the deliberations in the thematic break-away groups.

Break Away Sessions (Thematic groups):

Participants will be asked to proceed to their respective thematic break-away groups which shall be led by professional facilitators. The roles of the facilitators will be to ensure participation and to synergize the richness of the deliberations based on the groups collective experiences, lessons and concerns. This may be achieved either through the use of participatory methodologies such as group discussions, the world café etc.

Once the deliberations are over and are summed up by the facilitator, the lead paper will be presented to the group for it to further deliberate upon it. The concerned lead presenter will be briefed to try and link his presentation as much as possible to the prior discussions and to link it to the papers referred to for his presentation. This will be followed by a Q & A session where the presenter, as well as, the respective paper authors may contribute and or clarify issues.

Group Activity (thematic groups):

Post all the deliberations, presentations and Q & A sessions, the group will through a facilitated participatory process work to produce “The Ways Forward and Recommendations”. They will strive to come up with actionable ideas for research, policy and pilots, as well as, with suggestions and recommendations for policy and development.

Evening: Networking and Cultural Program

http://sdfnagaland.org/photography.html

↧

↧

Government's Unique Situation

Government's Unique Situation

As you know, if any element of the C + I + G + (Ex - Im) formula increases, then GDP—total demand—increases. If the “G” portion—government spending at all levels—increases, then GDP increases. Similarly, if government spending decreases, then GDP decreases.When it comes to financial management, four characteristics of the government set it apart from households and businesses (the “C” and “I” in the formula):

EconoTip

The interest rate on U.S. bonds is considered the risk-free interest rate because there is no credit risk associated with them. There is, however, the risk of inflation. Therefore, the rate on a government security represents the price to “rent” that money for that period of time with the certainty that it will be paid back, plus any inflation premium.EconoTalk

The tax base in a nation, region, state, or city is the number of workers and businesses who can be taxed. The term usually refers to income taxes, but in the case of states and cities, it also refers to sales and property taxes.Bracket creep occurs when inflationary pressure increases wages and pushes a worker into a higher tax bracket. This puts a “double whammy” on the worker, who loses purchasing power—wage-push inflation often increases prices faster than wages—and pays more in taxes. But it helps keep inflationary pressures under control.

- Government has the power to tax, which gives it greater control over its revenue. Federal, state, and local governments can mandate higher taxes and increase their revenues. Households and businesses have the more difficult task of selling their labor, goods, and services in order to raise revenue.

- By increasing or decreasing taxes, the government affects households' level of disposable income (after-tax income). A tax increase will decrease disposable income, because it takes money out of households. A tax decrease will increase disposable income, because it leaves households with more money. Disposable income is the main factor driving consumer demand, which accounts for two-thirds of total demand.

- The federal government can finance budget deficits by borrowing in the financial markets. Investors consider U.S. government bonds to be risk free, because they are backed by the taxing power of the government. States and cities also issue bonds to finance deficits. These bonds, however, are considered riskier because the tax base of the state or city could erode.

- The federal government—and only the federal government—can print more money. Like raising taxes, this has potential economic consequences (in the form of higher inflation) as well as political consequences. Nevertheless, the federal government does have that option, which is certainly not open to households and businesses.

Fiscal Fundamentals

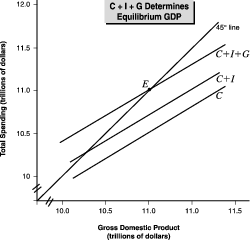

Fiscal policy is the general name for the federal government's taxation and expenditure decisions and activities, particularly as they affect the economy. (Monetary policy refers to policies that affect interest rates and the money supply.)Figure 13.1 shows how C + I + G add up to determine the equilibrium level of GDP. (For convenience, we're assuming that net exports (Ex - Im) are zero.) Line “C” represents consumption by consumers. Line “C+I” represents consumption by consumers plus investment by businesses. Line “C+I+G” represents consumption plus investment plus government spending.

Where is the actual equilibrium point for the economy? Where the total demand of households, businesses, and government—C + I + G—equals their production. That equilibrium point occurs where the line C + I + G intersects the 45 degree line. At that point, which is point “E” on the chart, total spending (total demand) and total production (GDP) are equal.

What About Taxes?

Figure 13.1 ignores taxes, but they are a crucial element in fiscal policy.Taxes lower households' disposable income. The amount collected in taxes doesn't find its way into consumption (“C”). But if the government spends every dollar that it collects in taxes, then that amount does find its way into total demand through government expenditures. When that occurs, the GDP remains unaffected by taxes. The size of the economy is the same whether people choose to produce and consume private goods (angora sweaters) or public goods (army uniforms). The mix of goods doesn't affect the level of GDP, as long as the total amount spent on them doesn't change.

What happens when the government collects more in taxes than it spends?

Total spending—and therefore the equilibrium level of GDP—decreases. Suppose that the money for army uniforms is collected but not spent. In that case, there's no need to manufacture the uniforms, no need to staff the uniform factory, and no need to pay the workers, who now have less income to devote to consumption.

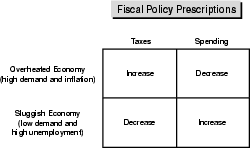

In general, when the government brings in more in taxes than it spends, it reduces disposable income and slows the growth of the economy. So, the fiscal policy prescription to stabilize an overheated economy is higher taxes.

In times of inflation—when too much demand is bidding up prices—a tax increase, coupled with no increase in government spending, will dampen the upward pressure on prices. The tax increase lowers demand by lowering disposable income. As long as that reduction in consumer demand is not offset by an increase in government demand, total demand decreases.

A decrease in taxes has the opposite effect on income, demand, and GDP. It will boost all three, which is why people cry out for a tax cut when the economy is sluggish. When the government decreases taxes, disposable income increases. That translates to higher demand (spending) and increased production (GDP). So, the fiscal policy prescription for a sluggish economy and high unemployment is lower taxes.

Spending policy is the mirror image of tax policy. If the government were to keep taxes the same, but decrease its spending, it would have the same effect as a tax increase, but through a slightly different channel. Instead of decreasing disposable income and decreasing consumption (“C”), a decrease in government spending decreases the “G” in C + I + G directly. The lower demand flows through to the larger economy, slows growth in income and employment, and dampens inflationary pressure.

Likewise, an increase in government spending will increase “G” and boost demand and production and reduce unemployment.

Those are the fundamentals of fiscal policy, and they are summed up in Figure 13.2.

Finally, the government can pursue its fiscal policy objectives more aggressively by simultaneously adjusting both taxes and spending. For instance, in a sluggish economy, the government could decrease taxes and increase spending at the same time. Each could be adjusted either by small amounts, so that neither taxes nor spending are changed too radically, or by large amounts to deliver a stronger dose of fiscal stimulus. Similarly, in an overheated economy, the government could increase taxes and decrease spending, if it wanted to dampen growth (and enrage voters).

Other Issues in Fiscal Policy

To keep things simple, the previous section omitted three other aspects of fiscal policy: the automatic stabilizing influence of fiscal policy, the multiplier effect, and the propensity to spend or save.First, fiscal policy exerts an automatic stabilizing effect on the economy, even when the government makes no explicit changes in its tax or spending plans.

When the economy contracts, tax receipts automatically decrease (because incomes decrease). This effect is magnified by progressive taxation, our system applying higher tax rates to higher incomes. Workers who are laid off or lose their overtime pay automatically fall into a lower tax bracket. Their lower taxes bills will partially offset the effect of their lost income. Similarly, when incomes rise, particularly during inflation, bracket creep pushes people into higher tax brackets. The higher taxes they pay takes money out of their pockets—money they can no longer use to bid prices up even higher.

Government spending also acts as an automatic stabilizer, especially during downturns. The federal government tends to maintain its general level of spending during recessions, which ensures a solid baseline level of demand from the “G” in C + I + G. Also, programs of unemployment insurance and public assistance help to ease the burden of tough times on households.

Second, the multiplier will boost the effect of an increase or reduction in taxes or spending. For instance, an extra dollar of government spending will flow through the economy and, by being repeatedly respent, will magnify the stimulus provided by that incremental dollar. Likewise, a dollar of reduced spending will take a dollar out of the economy, and the multiplier applies to that as well.

Finally, like the multiplier, the propensities to spend and to save are at work. If the government reduces taxes to stimulate consumption, but households save the money rather than spend it, consumption will not rise, nor will investment. If people save the money, they are “sitting on their wallets” and consumption remains low. If consumption is low, businesses won't invest. This has been a problem in the application of fiscal stimulus in Japan, where people tend to save increases in income.

Excerpted from The Complete Idiot's Guide to Economics© 2003 by Tom Gorman. All rights reserved including the right of reproduction in whole or in part in any form. Used by arrangement with Alpha Books, a member of Penguin Group (USA) Inc.

Excerpted from The Complete Idiot's Guide to Economics© 2003 by Tom Gorman. All rights reserved including the right of reproduction in whole or in part in any form. Used by arrangement with Alpha Books, a member of Penguin Group (USA) Inc.To order this book direct from the publisher, visit the Penguin USA website or call 1-800-253-6476. You can also purchase this book at Amazon.com and Barnes & Noble.

↧

What is the CPI?

nflation India 2013 |

Using the tabs you can switch between the 2013 CPI inflation overview and the 2013 HICP inflation overview. In case you are interested in the long term development of the inflation in India (CPI), click here. For the current inflation in India (CPI), click here. Following link provides you with an overview of current inflation by country (CPI).

Chart - CPI inflation India 2013 (yearly basis)

|

| The average inflation of India in 2013: 11.14 % |

Table - 2013 inflation India (CPI)

|

Historic CPI inflation India

nflation India 2013 |

Using the tabs you can switch between the 2013 CPI inflation overview and the 2013 HICP inflation overview. In case you are interested in the long term development of the inflation in India (CPI), click here. For the current inflation in India (CPI), click here. Following link provides you with an overview of current inflation by country (CPI).

Chart - CPI inflation India 2013 (yearly basis)

|

| The average inflation of India in 2013: 11.14 % |

Table - 2013 inflation India (CPI)

|

Historic CPI inflation India

nflation India 2013 |

Using the tabs you can switch between the 2013 CPI inflation overview and the 2013 HICP inflation overview. In case you are interested in the long term development of the inflation in India (CPI), click here. For the current inflation in India (CPI), click here. Following link provides you with an overview of current inflation by country (CPI).

Chart - CPI inflation India 2013 (yearly basis)

|

| The average inflation of India in 2013: 11.14 % |

Table - 2013 inflation India (CPI)

|

Historic CPI inflation India

http://www.inflation.eu/inflation-rates/india/historic-inflation/cpi-inflation-india-2013.aspx

nflation India 2013 |

Using the tabs you can switch between the 2013 CPI inflation overview and the 2013 HICP inflation overview. In case you are interested in the long term development of the inflation in India (CPI), click here. For the current inflation in India (CPI), click here. Following link provides you with an overview of current inflation by country (CPI).

Chart - CPI inflation India 2013 (yearly basis)

|

| The average inflation of India in 2013: 11.14 % |

Table - 2013 inflation India (CPI)

|

Historic CPI inflation India

|

Inflation India 2013 |

Using the tabs you can switch between the 2013 CPI inflation overview and the 2013 HICP inflation overview. In case you are interested in the long term development of the inflation in India (CPI), click here. For the current inflation in India (CPI), click here. Following link provides you with an overview of current inflation by country (CPI).

Chart - CPI inflation India 2013 (yearly basis)

|

| The average inflation of India in 2013: 11.14 % |

Table - 2013 inflation India (CPI)

|

Historic CPI inflation India

|

Inflation India 2013 |

Using the tabs you can switch between the 2013 CPI inflation overview and the 2013 HICP inflation overview. In case you are interested in the long term development of the inflation in India (CPI), click here. For the current inflation in India (CPI), click here. Following link provides you with an overview of current inflation by country (CPI).

Chart - CPI inflation India 2013 (yearly basis)

|

| The average inflation of India in 2013: 11.14 % |

Table - 2013 inflation India (CPI)

|

Historic CPI inflation India

What is the CPI?

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.How is the CPI used?

The CPI affects nearly all Americans because of the many ways it is used. Following are major uses:- As an economic indicator. More.

- As a deflator of other economic series. More.

- As a means of adjusting dollar values. More.

Whose buying habits does the CPI reflect?

The CPI reflects spending patterns for each of two population groups: all urban consumers and urban wage earners and clerical workers. The all urban consumer group represents about 87 percent of the total U.S. population. It is based on the expenditures of almost all residents of urban or metropolitan areas, including professionals, the self-employed, the poor, the unemployed, and retired people, as well as urban wage earners and clerical workers. Not included in the CPI are the spending patterns of people living in rural nonmetropolitan areas, farm families, people in the Armed Forces, and those in institutions, such as prisons and mental hospitals. Consumer inflation for all urban consumers is measured by two indexes, namely, the Consumer Price Index for All Urban Consumers (CPI-U) and the Chained Consumer Price Index for All Urban Consumers (C-CPI-U). ( See the answer to Question 4 for an explanation of the differences between the CPI-U and C-CPI-U.)The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) is based on the expenditures of households included in the CPI-U definition that also meet two requirements: more than one-half of the household's income must come from clerical or wage occupations, and at least one of the household's earners must have been employed for at least 37 weeks during the previous 12 months. The CPI-W population represents about 32 percent of the total U.S. population and is a subset, or part, of the CPI-U population.

Is the CPI a cost-of-living index?

The CPI frequently is called a cost-of-living index, but it differs in important ways from a complete cost-of-living measure. BLS has for some time used a cost-of-living framework in making practical decisions about questions that arise in constructing the CPI. A cost-of-living index is a conceptual measurement goal, however, and not a straightforward alternative to the CPI. A cost-of-living index would measure changes over time in the amount that consumers need to spend to reach a certain utility level or standard of living. Both the CPI and a cost-of-living index would reflect changes in the prices of goods and services, such as food and clothing, that are directly purchased in the marketplace; but a complete cost-of-living index would go beyond this role to also take into account changes in other governmental or environmental factors that affect consumers' well-being. It is very difficult to determine the proper treatment of public goods, such as safety and education, and other broad concerns, such as health, water quality, and crime, that would constitute a complete cost-of-living framework. More.Does the CPI measure my experience with price change?

Not necessarily. It is important to understand that BLS bases the market baskets and pricing procedures for the CPI-U and CPI-W populations on the experience of the relevant average household, not of any specific family or individual. It is unlikely that your experience will correspond precisely with either the national indexes or the indexes for specific cities or regions. More.How is the CPI market basket determined?

The CPI market basket is developed from detailed expenditure information provided by families and individuals on what they actually bought. For the current CPI, this information was collected from the Consumer Expenditure Surveys for 2009 and 2010. In each of those years, about 7,000 families from around the country provided information each quarter on their spending habits in the interview survey. To collect information on frequently purchased items, such as food and personal care products, another 7,000 families in each of these years kept diaries listing everything they bought during a 2-week period.Over the 2 year period, then, expenditure information came from approximately 28,000 weekly diaries and 60,000 quarterly interviews used to determine the importance, or weight, of the more than 200 item categories in the CPI index structure.

What goods and services does the CPI cover?

The CPI represents all goods and services purchased for consumption by the reference population (U or W) BLS has classified all expenditure items into more than 200 categories, arranged into eight major groups. Major groups and examples of categories in each are as follows:- FOOD AND BEVERAGES (breakfast cereal, milk, coffee, chicken, wine, full service meals, snacks)

- HOUSING (rent of primary residence, owners' equivalent rent, fuel oil, bedroom furniture)

- APPAREL (men's shirts and sweaters, women's dresses, jewelry)

- TRANSPORTATION (new vehicles, airline fares, gasoline, motor vehicle insurance)

- MEDICAL CARE (prescription drugs and medical supplies, physicians' services, eyeglasses and eye care, hospital services)

- RECREATION (televisions, toys, pets and pet products, sports equipment, admissions);

- EDUCATION AND COMMUNICATION (college tuition, postage, telephone services, computer software and accessories);

- OTHER GOODS AND SERVICES (tobacco and smoking products, haircuts and other personal services, funeral expenses).

The CPI does not include investment items, such as stocks, bonds, real estate, and life insurance. (These items relate to savings and not to day-to-day consumption expenses.)

For each of the more than 200 item categories, using scientific statistical procedures, the Bureau has chosen samples of several hundred specific items within selected business establishments frequented by consumers to represent the thousands of varieties available in the marketplace. For example, in a given supermarket, the Bureau may choose a plastic bag of golden delicious apples, U.S. extra fancy grade, weighing 4.4 pounds to represent the Apples category.

How are CPI prices collected and reviewed?

Each month, BLS data collectors called economic assistants visit or call thousands of retail stores, service establishments, rental units, and doctors' offices, all over the United States, to obtain information on the prices of the thousands of items used to track and measure price changes in the CPI. These economic assistants record the prices of about 80,000 items each month, representing a scientifically selected sample of the prices paid by consumers for goods and services purchased.During each call or visit, the economic assistant collects price data on a specific good or service that was precisely defined during an earlier visit. If the selected item is available, the economic assistant records its price. If the selected item is no longer available, or if there have been changes in the quality or quantity (for example, eggs sold in packages of ten when they previously were sold by the dozen) of the good or service since the last time prices were collected, the economic assistant selects a new item or records the quality change in the current item.

The recorded information is sent to the national office of BLS, where commodity specialists who have detailed knowledge about the particular goods or services priced review the data. These specialists check the data for accuracy and consistency and make any necessary corrections or adjustments, which can range from an adjustment for a change in the size or quantity of a packaged item to more complex adjustments based upon statistical analysis of the value of an item's features or quality. Thus, commodity specialists strive to prevent changes in the quality of items from affecting the CPI's measurement of price change.

How is the CPI calculated?

The CPI is a product of a series of interrelated samples. First, using data from the 1990 Census of Population, BLS selected the urban areas from which data on prices were collected and chose the housing units within each area that were eligible for use in the shelter component of the CPI. The Census of Population also provided data on the number of consumers represented by each area selected as a CPI price collection area. Next, another sample (of about 14,500 families each year) served as the basis for a Point-of-Purchase Survey that identified the places where households purchased various types of goods and services. More.How are taxes treated in the CPI?

Certain taxes are included in the CPI, namely, taxes that are directly associated with the purchase of specific goods and services (such as sales and excise taxes). Government user fees are also included in the CPI. For example, toll charges and parking fees are included in the transportation category, and an entry fee to a national park would be included as part of the admissions index. In addition, property taxes should be reflected indirectly in the BLS method of measuring the cost of the flow of services provided by shelter, which we called owners' equivalent rent, to the extent that these taxes influence rental values. Taxes not directly associated with specific purchases, such as income and Social Security taxes, are excluded, as are the government services paid for through those taxes.For certain purposes, one might want to define price indexes to include, rather than exclude, income taxes. Such indexes would provide an answer to a question different from the one to which the present CPI is relevant, and would be appropriate for different uses.

How do I read or interpret an index?

An index is a tool that simplifies the measurement of movements in a numerical series. Most of the specific CPI indexes have a 1982-84 reference base. That is, BLS sets the average index level (representing the average price level)-for the 36-month period covering the years 1982, 1983, and 1984-equal to 100. BLS then measures changes in relation to that figure. An index of 110, for example, means there has been a 10-percent increase in price since the reference period; similarly, an index of 90 means a 10-percent decrease. Movements of the index from one date to another can be expressed as changes in index points (simply, the difference between index levels), but it is more useful to express the movements as percent changes. This is because index points are affected by the level of the index in relation to its reference period, while percent changes are not.In the table that follows, Item A increased by half as many index points as Item B between Year I and Year II. Yet, because of different starting indexes, both items had the same percent change; that is, prices advanced at the same rate. By contrast, Items B and C show the same change in index points, but the percent change is greater for Item C because of its lower starting index value.

| Item A | Item B | Item C | |

|---|---|---|---|

| Year I | 112.500 | 225.000 | 110.000 |

| Year II | 121.500 | 243.000 | 128.000 |

| Change in index points | 9.000 | 18.000 | 18.000 |

| Percent change | 9.0/112.500 x 100 = 8.0 | 18.0/225.000 x 100 = 8.0 | 18.0/110.000 x 100 = 16.4 |

Is the CPI the best measure of inflation?

Inflation has been defined as a process of continuously rising prices or equivalently, of a continuously falling value of money.Various indexes have been devised to measure different aspects of inflation. The CPI measures inflation as experienced by consumers in their day-to-day living expenses; the Producer Price Index (PPI) measures inflation at earlier stages of the production process; the Employment Cost Index (ECI) measures it in the labor market; the BLS International Price Program measures it for imports and exports; and the Gross Domestic Product Deflator (GDP Deflator) measures inflation experienced by both consumers themselves as well as governments and other institutions providing goods and services to consumers. Finally, there are specialized measures, such as measures of interest rates.

The "best" measure of inflation for a given application depends on the intended use of the data. The CPI is generally the best measure for adjusting payments to consumers when the intent is to allow consumers to purchase at today's prices, a market basket of goods and services equivalent to one that they could purchase in an earlier period.

Which index is the "Official CPI" reported in the media?

Our broadest and most comprehensive CPI is called the All Items Consumer Price Index for All Urban Consumers (CPI-U) for the U.S. City Average, 1982-84 = 100.In addition to the All Items CPI, BLS publishes thousands of other consumer price indexes. One such index is called "All items less food and energy". Some users of CPI data use this index because food and energy prices are relatively volatile, and these users want to focus on what they perceive to be the "core" or "underlying" rate of inflation.

Again, while we publish many indexes, our broadest measure of inflation includes all items consumers purchase, including food and energy. In addition, when CPI data are reported, these data can be reported on a not seasonally adjusted basis as well as a seasonally adjusted basis. Often, the media will report some, or all, of the following:

- Index level, not seasonally adjusted. (for example, May 2008 = 216.632).

- 12-month percent change, not seasonally adjusted. (for example, May 2007 to May 2008 = 4.2 percent).

- 1-month percent change on a seasonally adjusted basis. (for example, from April 2008 to May 2008 = 0.6 percent).

- Annual rate of percent change so far this year (for example, from December 2007 to May 2008 if the rate of increase over the first 5 months of the year continued for the full year, after the removal of seasonal influences, the rise would be 4.0 percent).